Summary of Explaining "Not-QE"

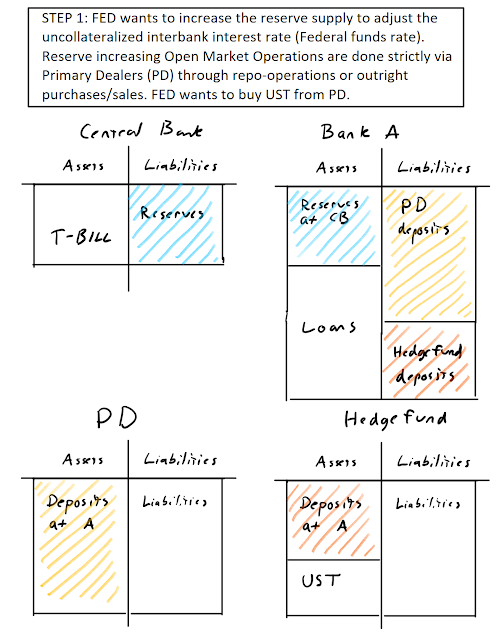

All though there are even more dynamics in play than what I have described in my previous post, I had multiple requests on making a shorter summary of it. I’ll try to keep this one as short as possible, but if you wish to have more detailed (but not detailed enough imo.) description of the core of my argument, please refer to my previous post . Here we go. Before the Global Financial Crisis (GFC), the implementation method of how the Federal Reserve (FED) implemented its monetary policy in order to attain its SHORT-TERM rate target was called a “corridor system”. This is a corridor system that came with three important factors. First, it had a roof, or the discount window , which is a “lender-of-last-resort” channel to get funding if balances at the FED are overdrawn. Second, there was a floor, which was the zero lower bound (ZLB), or Federal Funds Rate = 0% and third, and from the perspective of current issues the most important one, reserve scarcity (deposits at the FED ...