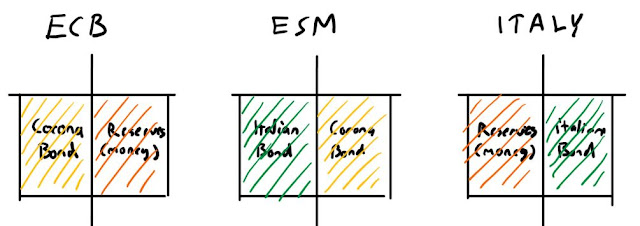

A Proposal on how to save the eurozone...for now!

For the current crisis, the ECB had to intervene with a sizeable 750billion € Pandemic Emergency Purchase Programme (PEPP) . This program comes with a plan to buy 750 billion € worth of private and public sector securities across the yield curve (from 70day to 30year) and the purchases are to be made "flexibly", but in the long in the end according to capital keys . Also, one major feature of this program is the rule that purchases made under PEPP are not to be counted in issuer limits according to which the ECB can only hold 33% of all available government debt issuances in order to avoid being a decisive vote in a case of debt restructuring. In plain English, this means that the ECB can temporarily purchase any amount (in short term, the purchase allocation does not have to follow capital keys), within the capped 750billion € limit, of any government securities it wishes (Italian debt for example). The fact that PEPP purchases have no effect on the issuer limit is a major