Summary of Explaining "Not-QE"

All though there are even more dynamics in play than what I have

described in my previous post, I had multiple requests on making a shorter

summary of it. I’ll try to keep this one as short as possible, but if you wish to

have more detailed (but not detailed enough imo.) description of the core of my argument, please refer to my previous post.

Here we go.

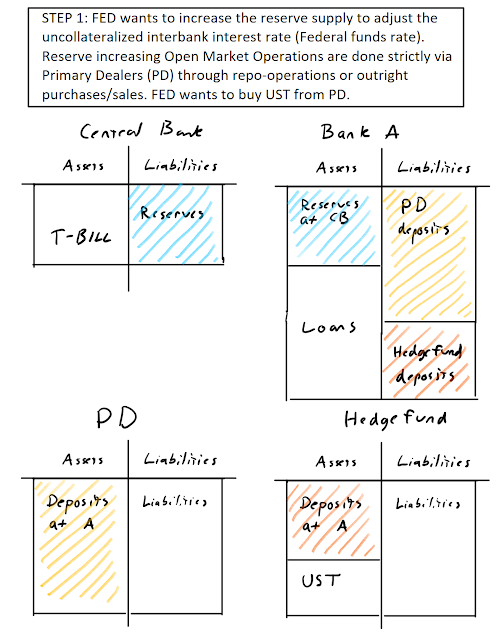

Before the Global Financial Crisis (GFC), the implementation method of how the Federal Reserve (FED) implemented its monetary policy in order to attain its

SHORT-TERM rate target was called a “corridor system”. This is a corridor system that came with three

important factors. First, it had a roof, or the discount window, which is a “lender-of-last-resort” channel to get funding if balances at the FED are overdrawn. Second, there was a floor, which was the zero lower bound (ZLB), or Federal Funds Rate

= 0% and third, and from the perspective of current issues the most important one,

reserve scarcity (deposits at the FED by financial institutions were short in

supply). With a system where bank reserves are scarce, even minor interventions

by the FED affect the rate greatly. Traditionally the reserves banks held in aggregate

were just slightly above that what was required by reserve requirement. In this system, the FED set a target rate and forced the actual

prevailing Effective Federal Funds Rate (EFFR) to fluctuate near this target by

constant and DAILY interventions by mainly repo-operations (collateral repoed was T-bills, i.e. short-term <1 year Treasury paper).

If there was excessive reserve supply and the rate tended to be lower than what was the target then the FED intervened by reducing reserves and thus pushing rate closer

to the target. When there were too little reserves and correspondingly too high

EFFR, they responded by increasing the reserves and pushing the rate closer to

target.

Ideally, monetary policy works through maturity transformation. Maturity transformation is a process where banks borrow

short and lend long term. When FED lowers short-term rates the yield curve artificially

steepens and the spread between short- and long-term rates increases, making

banking more profitable. This induces competitive lending and thus cheaper

borrowing and through that increases economic activity and inflation. During GFC the banks were spooked out of the markets to lend money and the FED had to intervene in order to push the long end of the yield curve lower to attain its desired inflation targets. In order to do this, the FED had to introduce Quantitative Easing (QE) programs which increased the size of FED's balance sheet and correspondingly the amount of reserves. QE is supposed to lower LONG-TERM rates by reducing the supply of long-term US treasury paper and concomitantly increase their price and reduce yield. When in a reserve scarce system there is a sudden massive supply of reserves, it will push the federal funds rate down to the zero lower bound. With a massive amount of reserves in the system, the FED had lost control of short term rates. In order to get rates back under control, the FED introduced an Interest Rate on Excess Reserves (IOER). This is the rate FED pays to banks holding money at the FED in excess of that what is actually needed by reserve requirements. Theoretically, no bank should lend reserves at a rate below IOER as it would bring a risk-free arbitrage opportunity (borrow below IOER and deposit the proceeds at the FED for IOER and reap the spread as a profit). When IOER was initially introduced it did not work as was supposed and rates dropped right through it. The reason was that not all institutions that have an account at the FED get IOER paid to them. Government Sponsored Enterprises (GSE) also held accounts at the FED and were not eligible for IOER. This built an arbitrage opportunity where GSE lends at any rate above 0 to a bank eligible for IOER so that the bank profits and GSE gets better than nothing. This new system was called a "floor system" where reserves are abundant and IOER works as a floor. However, IOER actually worked as a roof and the ZLB as a floor due to the arbitrage conducted by GSE's. IOER was thus set as fed funds upper target and ZLB as lower target and EFFR should fluctuate somewhere between.

When FED monetary policy normalization began, the FED had to find a way to get its short-term rates back under control by finding a way to introduce a lower target that could be increased (unlike ZLB). The new tool was an Overnight Reverse Repo (ON RRP), where the FED borrowed money in the repo market against collateral found on its balance sheet. Unlike IOER, also GSE's (and money market funds and some other financial institutions) were eligible to participate as an ON RRP counterparty. This liquidity reducing operation ensured that no GSE should lend at a rate less than what it can get at the FED, risk-free. This is how the current floor system stands as of now. There is an upper target range, IOER, and a lower target range, ON RRP, and the EFFR fluctuates somewhere between.

Now, what happened when they started their balance sheet reduction operations or the Quantitative Tightening (QT)? It REDUCED the amount of reserves in the banking system, pushing the supply curve of reserves closer to a point (leftwards) where the system is closer to tipping back to a corridor system. While they did QT, other things were also in play. Because of a floor system, the FED didn't have to actively monitor the balances the US government held at its Treasury General Account (TGA) or they did not have to care how much the foreign institutions having accounts at the FED invest (and thus hoard reserves) in the Foreign Repo Pool. The US government optimized its finance by shifting its deposit account strictly to FED as it had a reserve reducing effect and thus reduced the amount the FED had to pay to banks as IOER and increased the amount the FED had leftover to pay to the US government as a profit. All money that is either sent to TGA or held at foreign institutions account is money (reserves) less for the banking system. Another factor reducing reserve supply in the system is cash in circulation. All these factors push the supply curve of reserves leftwards, thus gradually pushing the whole monetary policy implementation method closer to a corridor system.

An important factor in increasing reserve demand is regulation. BASEL III regulation introduced e.g. Liquidity Coverage Ratio (LCR) which requires banks to hold enough High-Quality Liquid Assets (HQLA) in order to sustain a 30-day period under serious liquidity stress. HQLA's include Excess Reserves, Treasuries, Agency MBS and some other thought to be highly secure assets, but at least some HQLA held MUST BE excess reserves. LCR and other regulations such as stress test/resolution related regulations increase reserve demand in excess of what the banks would otherwise need. Also, QT by itself through complicated intraday liquidity dynamics increase reserve demand (Primary dealers).

So why "Not-QE" is not a QE? What most likely happened in September 2019 "repocalypse", was that with all these factors in play, increasing reserve demand and reduction in reserve supply, the FED accidentally pushed the supply curve a bit too far left and demand curve a bit too far right thus tipping the floor system back to a corridor system. This caused a spike in repo rates as institutions thought to have "too much excess" actually had too little excess and thus were shunned to lend into the repo market on the eve of the hiccup. In order to keep on implementing policy as a floor system (as they have stated they would like to do), an intervention had to be made, first on the repo markets so that immediate panic could be dampened and second by starting T-Bill (SHORT TERM) purchases in order to increase reserve balances and thus push the supply curve rightwards once more. A QE is characterized by an aim to target the LONG END of the yield curve and the recent actions were about keeping SHORT TERM rates under control. If we are to have a central bank in the first place and it is to conduct monetary policy through controlling short term rates, then all means to make sure that this rate is under their control are not just advisable, but are part of their MAIN JOB.

Comments

Post a Comment