A Proposal on how to save the eurozone...for now!

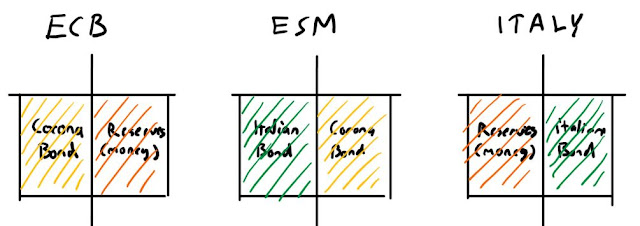

For the current crisis, the ECB had to intervene with a sizeable 750billion € Pandemic Emergency Purchase Programme (PEPP). This program comes with a plan to buy 750 billion € worth of private and public sector securities across the yield curve (from 70day to 30year) and the purchases are to be made "flexibly", but in the long in the end according to capital keys. Also, one major feature of this program is the rule that purchases made under PEPP are not to be counted in issuer limits according to which the ECB can only hold 33% of all available government debt issuances in order to avoid being a decisive vote in a case of debt restructuring. In plain English, this means that the ECB can temporarily purchase any amount (in short term, the purchase allocation does not have to follow capital keys), within the capped 750billion € limit, of any government securities it wishes (Italian debt for example). The fact that PEPP purchases have no effect on the issuer limit is a major factor here. It means that the possible failure in the short term to decide on corona bonds may not become such a detrimental factor in saving the eurozone from collapsing into another euro crisis in the near term. The plan to have common euro-area bonds (corona bonds) issued comes with a new useful mechanism of how ECB could potentially become the de facto funder of eurozone government deficits. The "cunning" plan is to have a workaround for the Article 123(1) TFEU banning direct government finance by ECB (participating in primary market government debt issuance) by having an agency such as European Stability Mechanism (ESM) to issue corona bonds that the ECB will buy and to have ESM to lend money directly (on primary markets) to Eurozone governments in order to fund their respective deficits. These purchases by the ECB of ESM issued debt, or corona bonds, would not count as being direct funding of the eurozone governments. The issue of corona bonds is highly political and prolonged debate on the matter can become costly as the eurozone is potentially sliding into another euro crisis.

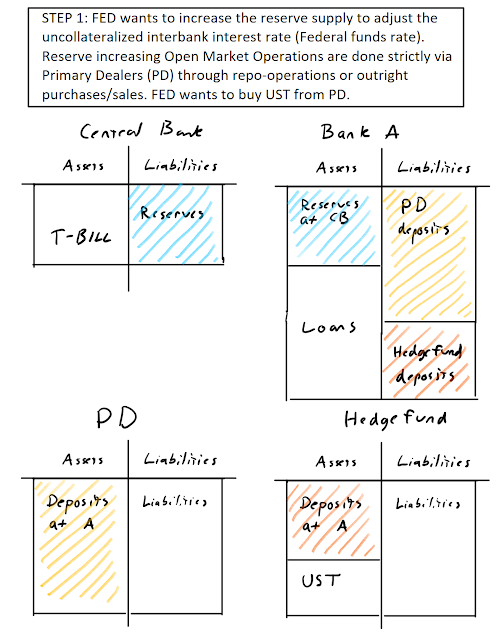

My proposition for the ECB to get around these political problems (if it wishes to help eurozone government to fund their deficits) would be to follow what the Fed has done with the Primary Dealer Credit Facility. A primary dealer is a financial company acting as a market maker for government securities, with an obligation to ensure that government debt issuance does not fail to meet demand. Basically, this ensures that governments will always find someone to fund her deficits as long as the Primary Dealers in question stay afloat (this is an issue in Italy, where primary dealer banks are under pressure to refinance Italian governments debt issuances). A handbook (including lists by country) of European Primary Dealers can be found here.

In order to implement this proposition, the ECB should make a temporary program (lasting until the crisis is deemed over) that allows all (or up to some limit) debt securities with a maturity of less than 5 years (could be shorter), bought by the Primary Dealers from government debt auctions to be used as collateral (with no haircut) for loans from the ECB at lucrative rates below the respective government securities yield. This loan could be made on a non-recourse basis so that defaulting would only require handing over collateral, without any further repercussions. As the ECB would roll over all loans taken for this purpose by the Primary Dealers for the full length of the debt instrument, it means that the ECB essentially locks in the securities on its balance sheet. This would effectively guarantee that governments will be able to finance their massive corona deficits without pushing interbank market rates off the roof. Here, the ECB would only be lending money to banks (Primary Dealers are often part of the corporate bank segment of a bank) as it is supposed to do and thus the items shown on ECBs balance sheet are not government securities, but collateralized lending to primary dealers. With the collateral being "the best in the game", being government debt securities after all (yes, Italian debt is far from best, but whatever), the ECB would not be seen being as imprudent in its lending activity as it might be when it alternatively could be backstopping the whole money market with a wider collateral pool. When the ECB takes on the job of refinancing government debt issuance through primary dealers, the primary dealers do not have to crowd the money markets with their bids for short-term financing in order to finance their "forced" buying of government debt securities. This eases the pressure on money markets during a crisis, enabling other institutional financing activity to function as normally as it possibly can, given the circumstances. As the debt securities bought under this program would be short to medium term in maturity, it communicates the temporary nature of this type of financing.

However, this constant lending process by the ECB increases the amount of reserves in the banking system if not sterilized. Sterilization might be advisable here so that unwinding of the program becomes easier. As in a case where reserves are sterilized as they appear, banks would not get used to having, say 20 trillion € excess reserves incurred through the use of this facility, it could be easier to withdraw them after the program is over. Even if someone does not believe that the amount of reserves matter at all for the banking sector in a "floor system" environment, still many in the financial community understand reserves as a factor of liquidity nevertheless. If reserves were sterilized in the first place, withdrawing them would not affect this thought to be liquidity in the system, thus it should not affect investor expectations so drastically (tightening monetary policy). One proposal on sterilization could be that national central banks cap (to a small figure) the use of government reserve accounts, forcing governments to have most of their money on deposit accounts at, say, Primary Dealer banks. All reserves incurred through the use of this facility would be asked to deposit in ECB's term-deposit account paying 0% interest, this could avoid penalizing the banking sector through negative deposit rates. Another sterilization method could be to issue central bank bonds in order to withdraw reserves out of the banking system.

In my opinion, this kind of arrangement, could be met with the least resistance as it is basically following an already used funding framework by other major central banks (mostly Fed) and it avoids the legal problem of ECB holding excessive amount of government debt directly on its balance sheet. It can also be argued to be within ECB's monetary policy operations of controlling short term interest rates as excessive money market pressure should warrant central bank action anyways. This could just be an another way to ease that pressure. The European Primary Dealer Facility could make corona bonds unnecessary to solve the current crisis and the political debate of having common debt instrument could be postponed for better times.

Although euro might not be a project worth saving in the long run, it surely is worth saving for now! Even if I am a long term euro-bear, I rather have all other crises postponed for now. With this new trick, we could do just that and potentially avoid having a new euro crisis and the political risks coming with it....for now!

In order to implement this proposition, the ECB should make a temporary program (lasting until the crisis is deemed over) that allows all (or up to some limit) debt securities with a maturity of less than 5 years (could be shorter), bought by the Primary Dealers from government debt auctions to be used as collateral (with no haircut) for loans from the ECB at lucrative rates below the respective government securities yield. This loan could be made on a non-recourse basis so that defaulting would only require handing over collateral, without any further repercussions. As the ECB would roll over all loans taken for this purpose by the Primary Dealers for the full length of the debt instrument, it means that the ECB essentially locks in the securities on its balance sheet. This would effectively guarantee that governments will be able to finance their massive corona deficits without pushing interbank market rates off the roof. Here, the ECB would only be lending money to banks (Primary Dealers are often part of the corporate bank segment of a bank) as it is supposed to do and thus the items shown on ECBs balance sheet are not government securities, but collateralized lending to primary dealers. With the collateral being "the best in the game", being government debt securities after all (yes, Italian debt is far from best, but whatever), the ECB would not be seen being as imprudent in its lending activity as it might be when it alternatively could be backstopping the whole money market with a wider collateral pool. When the ECB takes on the job of refinancing government debt issuance through primary dealers, the primary dealers do not have to crowd the money markets with their bids for short-term financing in order to finance their "forced" buying of government debt securities. This eases the pressure on money markets during a crisis, enabling other institutional financing activity to function as normally as it possibly can, given the circumstances. As the debt securities bought under this program would be short to medium term in maturity, it communicates the temporary nature of this type of financing.

However, this constant lending process by the ECB increases the amount of reserves in the banking system if not sterilized. Sterilization might be advisable here so that unwinding of the program becomes easier. As in a case where reserves are sterilized as they appear, banks would not get used to having, say 20 trillion € excess reserves incurred through the use of this facility, it could be easier to withdraw them after the program is over. Even if someone does not believe that the amount of reserves matter at all for the banking sector in a "floor system" environment, still many in the financial community understand reserves as a factor of liquidity nevertheless. If reserves were sterilized in the first place, withdrawing them would not affect this thought to be liquidity in the system, thus it should not affect investor expectations so drastically (tightening monetary policy). One proposal on sterilization could be that national central banks cap (to a small figure) the use of government reserve accounts, forcing governments to have most of their money on deposit accounts at, say, Primary Dealer banks. All reserves incurred through the use of this facility would be asked to deposit in ECB's term-deposit account paying 0% interest, this could avoid penalizing the banking sector through negative deposit rates. Another sterilization method could be to issue central bank bonds in order to withdraw reserves out of the banking system.

In my opinion, this kind of arrangement, could be met with the least resistance as it is basically following an already used funding framework by other major central banks (mostly Fed) and it avoids the legal problem of ECB holding excessive amount of government debt directly on its balance sheet. It can also be argued to be within ECB's monetary policy operations of controlling short term interest rates as excessive money market pressure should warrant central bank action anyways. This could just be an another way to ease that pressure. The European Primary Dealer Facility could make corona bonds unnecessary to solve the current crisis and the political debate of having common debt instrument could be postponed for better times.

Although euro might not be a project worth saving in the long run, it surely is worth saving for now! Even if I am a long term euro-bear, I rather have all other crises postponed for now. With this new trick, we could do just that and potentially avoid having a new euro crisis and the political risks coming with it....for now!

Comments

Post a Comment