Central Bank balance sheet and COVID19

I have been reading multiple complaints about central banks ballooning their balance sheets in order to combat COVID19-crisis, mainly from the same people who are wondering if this will lead to hyperinflation as the amount of central bank money in the system is increasing rapidly. I am going to argue that it will not and that this crisis is a best case example of a situation where central banks must increase the size of their balance sheets.

In order to fight the virus, governments around the world had to resort in extreme measures, causing a full stoppage in business activity across sectors, barring people from even exiting their homes. However, as the businesses that are under forced lockdown are at the same time in need to meet their financial obligations, like rolling over their debt or paying employee salaries, some cash flow must be generated in order to avoid bankruptcy. If there is no cash flow and companies are in need to pay e.g. salaries, a new demand for debt financing emerges. This happens at a time when rolling over old debt becomes rather impossible as financial institutions are unlikely to do it (at least at reasonable rates or collateral demands) due to increased uncertainty about future cash flow prospects. Financial institutions also need to take care of their own solvency, so funding even a short term corporate commercial paper or issuing a loan to a small company becomes highly unlikely and on top of that comes with a regulatory cost. As financial institutions are extremely regulated, and cash flows dries up even for them (one proxy of this could be the sudden rise in EURIBOR recently), these institutions must start hoarding liquid assets such as central bank money or highly rated government debt instruments (which can be turned into central bank money easily). This essentially means that in a lockdown where the economy is intentionally frozen, the private balance sheet capacity (the potential for issuing new debt or rolling over old) disappears. If nothing is done to compensate for the lost capacity, we won't be facing just a historical health crisis, but a historical financial and economic crisis at the same time. This would erode the productive capacity of the whole economy for a long period and potentially driving millions into a poverty trap and causing major social problems. Also, it would shift focus from solving the health crisis to solving an economic crisis of historical magnitudes causing even more trouble for the healthcare sector and thus likely increase COVID19 death rates. Although an economic crisis is prone to come, reducing its impact and postponing is necessary at this point.

So what are the options when private balance sheet capacity disappears? There are two entities able to take on such a task. The government and the central bank. The government in question can supplement the lost balance sheet capacity through:

1. Her financing institutions (GSE's)

2. Through direct cash transfers.

3. Through off-balance sheet credit guarantees.

4. Supporting central bank financing vehicles by injecting capital in them.

As all of this, explicitly or implicitly, mean more government indebtedness, it becomes a major political issue. With already high debt levels and with a sudden need to supplement the private balance sheet capacity fully, possibly ballooning debt levels manifold, the political resistance is likely to be considerable, especially if the government was to assume this role alone without the help of the central bank. Combining increasing debt levels with diminishing GDP figures increases the debt/GDP ratio considerably, the same ratio that is often used as a proxy for governments' fiscal sustainability.

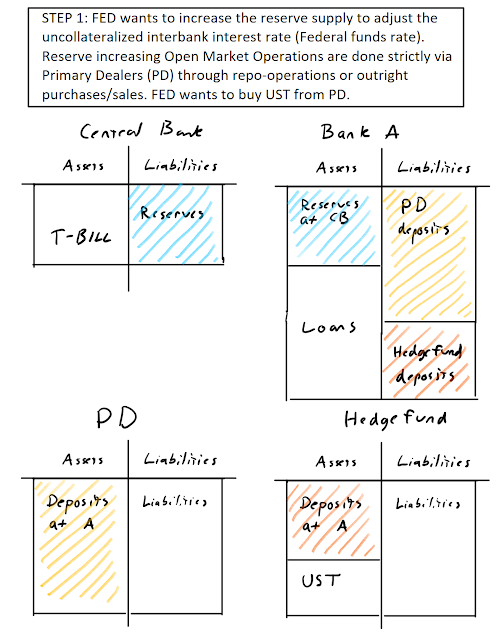

Now the central bank can and should come to the rescue in a case like this. The central bank can through its operations purchase money and capital market instruments (such as commercial paper and corporate bonds) off from private sectors balance sheets and lend central bank money against them and thus potentially free up balance sheet capacity from financial institutions to issue financing to non-financial companies in need (this, however, is unlikely given the uncertainty) and it can "directly" fund non-financial companies by rolling over their old debt or financing new debt issuances through different central bank financing vehicles. Most central banks cannot directly fund corporations (or governments), but they can get around this by establishing a financing vehicle entity that provides funding directly to companies (or governments) in need while the vehicle itself borrows money from the central bank to fund its portfolio. These companies mostly get loss-absorbing capital injected in them by governments.

All these operations naturally increase the size of the central bank balance sheet, but at the same time reduces the amount the government in question must increase its debt levels. The increase in central bank balance sheet is often taken to be a determining factor in looseness of monetary policy or "liquidity", but when private financial institutions stop rolling over debt and stop issuing new loans and when non-financial sector companies fail to meet their obligations, it will even with added central bank action likely reduce the net amount of money in the financial system. Liquidity is not increased per se, it is kept alive at least to some extent. Thus, the net effect of this "increased" liquidity is still being deflationary if anything. On top of that, given the modern central banks monetary policy implementation, the amount of reserves is not as relevant (but still relevant through what assets have been bought in order to suppress certain rates, namely the long end of the curve) as the looseness of monetary policy is controlled mainly through interest paid on reserves. What the central bank is doing here is trying to provide the needed balance sheet capacity to absorb this reduction in money supply by its lender of last resort role, keeping the amount of credit in the system approximately frozen for the time being. I do think that many fiscal conservatives rather see ballooning central bank balance sheets than extremely high government debt levels and maybe one main factor in why this "works" is the fact that the public (and politicians) are considerably unaware of how the monetary system works but can comprehend what government debt approximately mean.

All these operations naturally increase the size of the central bank balance sheet, but at the same time reduces the amount the government in question must increase its debt levels. The increase in central bank balance sheet is often taken to be a determining factor in looseness of monetary policy or "liquidity", but when private financial institutions stop rolling over debt and stop issuing new loans and when non-financial sector companies fail to meet their obligations, it will even with added central bank action likely reduce the net amount of money in the financial system. Liquidity is not increased per se, it is kept alive at least to some extent. Thus, the net effect of this "increased" liquidity is still being deflationary if anything. On top of that, given the modern central banks monetary policy implementation, the amount of reserves is not as relevant (but still relevant through what assets have been bought in order to suppress certain rates, namely the long end of the curve) as the looseness of monetary policy is controlled mainly through interest paid on reserves. What the central bank is doing here is trying to provide the needed balance sheet capacity to absorb this reduction in money supply by its lender of last resort role, keeping the amount of credit in the system approximately frozen for the time being. I do think that many fiscal conservatives rather see ballooning central bank balance sheets than extremely high government debt levels and maybe one main factor in why this "works" is the fact that the public (and politicians) are considerably unaware of how the monetary system works but can comprehend what government debt approximately mean.

Hey you have written an best article. Keep doing hard work success will come to you. Also please see this video on how Tesla Sues Alameda County.

ReplyDeleteTesla Sues Alameda County, Time to Buy TSLA?